Silicon Valley Bank execs' insider trading

Avoid insider trading allegations with this one weird trick.

Silicon Valley Bank went bust.

The CEO and CFO sold around $4M worth of stock two weeks prior.

$4M isn't that crazy a number, but that was 11% of the CEO's holdings, and 32% of the CFO's holdings.

Obviously, angry citizens of the internet crawled out of their caves to shun this insider trading.

But the angry citizens don't realise there's this thing called pre-scheduled stock sale plans, which executives often use to avoid insider trading allegations. And that's exactly what the execs did.

It works like this: An exec has to specify in advance how many stocks they want to sell, and at what price, and on what far-away future date. This means they won't have insider knowledge, because nobody can see the future. It's called a 10b5-1 plan.

... or that's what I thought.

I took a deeper look into the SEC filings and compiled this complex timeline:

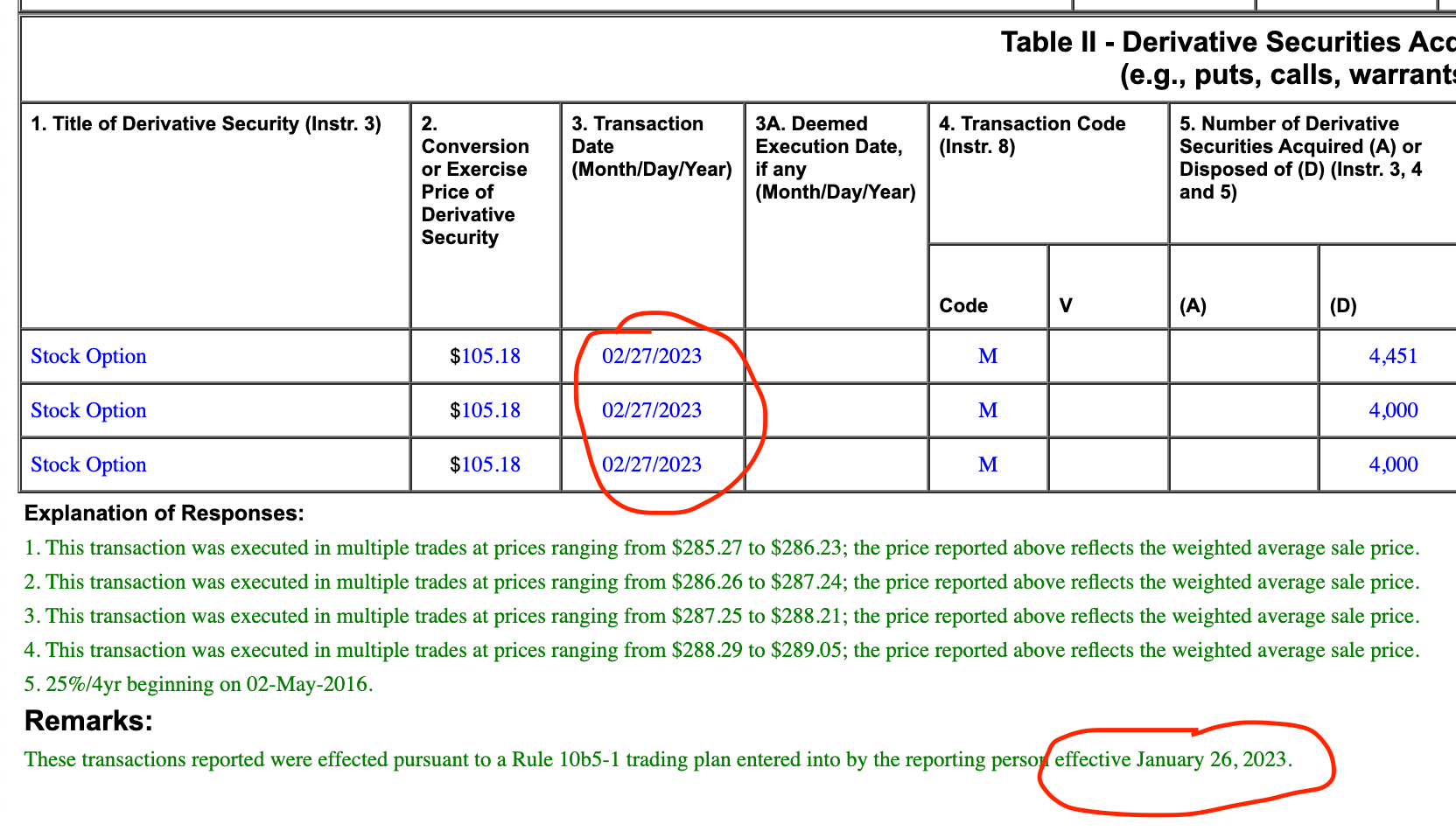

- January 26 - CFO and CEO enter into 10b5-1 trading plans.

- February 27 - they dump a bunch of shares. (CEO sauce, CFO sauce)

- March 10 - the bank is pronounced dead.

If that ain't insider trading, I don't know what is.

So... pre-scheduled isn't really that pre-scheduled?

Uh, yeah, so here's the thing. The law Investopedia says:

Rule 10b5-1 permits major holders to sell a predetermined number of shares at a predetermined time.

A predetermined time.

PRE. DETERMINED. TIME.

One would THINK that means it has to be at some point in the not-so-imminent future, no?

Yeah, nah.

As I have discovered, there were no laws around how far in advance that had to be. Legally, theoretically, you could enter a 10b5-1 plan for the next day if you really wanted to. It would be called ✨ predetermined ✨.

In practice, many issuers imposed their own 30-day minimum waiting periods.

And guess how long it was between Silicon Valley Banks CEO and CFO entering their 10b5-1 trading plans and selling their stock? 30 days.

So I guess their issuer had that 30-day period imposed.

Wait really? Surely the law is not that rubbish?

Okay, I lied. Kind of.

The good news is there is a mandatory waiting period between setting up a trading plan and selling stocks.

That is to say, there's a mandatory waiting period now. It came into effect on Feb 27, 2023, which happened to be after the Silicon Valley Bank execs sold their shares.

There's a period of 90 days imposed by law now. More nuance here.

Will they get done for insider trading?

I don't know.

Should they? I don't know.

They must've known the bank was in pretty deep trouble. But it's not insider trading if the public knows that too, and maybe the public knew that too.

What I care about is getting more knowledge about how players in the market act. More knowledge about how the world works == more trading knowledge.

Maybe a bank CFO selling one third of their stock will be a bigger tip off next time, and I'll be buying some Puts, or at least sitting on the sidelines with 🍿.