11 Sneaky investing strategies

Why analyse balance sheets when you could use satellites and lawyers?

During my search for trading strategies, I have come across a lot of creative approaches to investing and timing the market too. These are strategies of gathering information about companies that definitely go outside the box of your regular analysis of balance sheets or charts. Are they clever, or underhanded? Why not both? Maybe these are useful, or maybe they’re just amusing, but either way, these are my favourites.

1. Satellite Imagery 🛰

Investment firms have used satellite imagery, either to get an idea of wider economic trends or to predict a company's earnings before they're released.

Tracking shipping activity across the seas is one way they gather data on economic activity.

Monitoring crop growth and how full oil barrels are gives traders a serious advantage when trading futures. Some commodities producers have started covering their silos to prevent traders getting this upper hand.

Investors have also used satellite imagery to monitor how busy parking lots are at, say, Walmart, to be able to predict their earnings before they're officially announced.

2. Snooping Job Listings 💼

Watching a company's job ads can give insights into how fast the company is growing and what areas the company might be branching into.

For example, Apple is rumoured to be working on an electric car. There’s no guarantee that that’s true, or that it would be successful if it is true, but they’ve posted around 300 job ads for positions that look related to electric car development, which certainly gives some credence to the rumours.

On the opposite note, Nikola (a total scam company), have posted job listings for defence lawyers specialising in fraud cases. Tiny bit of a red flag there.

3. Monitoring Linkedin Analytics 🏃

The opposite of watching job posts. If it seems like people are en masse leaving a company, it might be a good time to exit the stock or short it.

4. Tracking Corporate Flights 🛫

I suspect this one is even more significant post-covid. There are sites where you can monitor where corporate flights and even the private jets of high-profile individuals like Elon Musk are going. This has been used to try and figure out if two particular companies are in talks with each other; i.e. it gets people thinking about mergers and acquisitions.

There’s no shortage of flights between the major cities, so you can’t derive much there, but there’s an example of a private jet that was owned by a petroleum company that flew to Omaha, the middle of nowhere. What's in Omaha for a petroleum company? Probably not a lot, except it’s where Warren Buffett’s firm works from. A hedge fund picked up on this and saw it as an opportunity, and what do you know, a few days after that flight, Buffett announced a $10b investment in that petroleum company.

5. Google Trends 📈

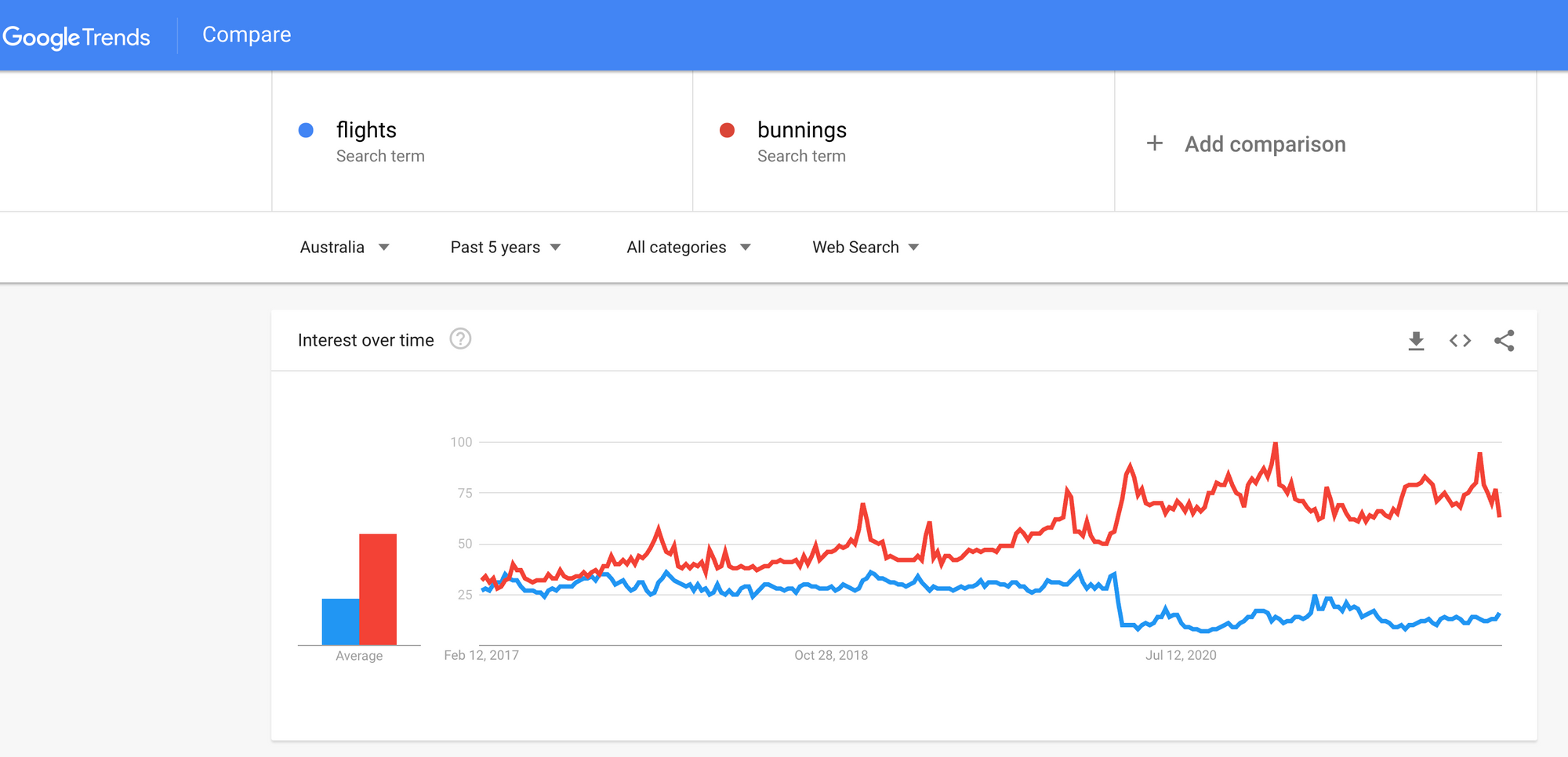

Google lets anyone search for how particular search terms have been trending over time and by location. For instance:

Analysts are using this to gauge sales for a company’s products or services and how it’s trending over time. This is exactly the online equivalent of using satellite imagery to monitor Walmart carparks.

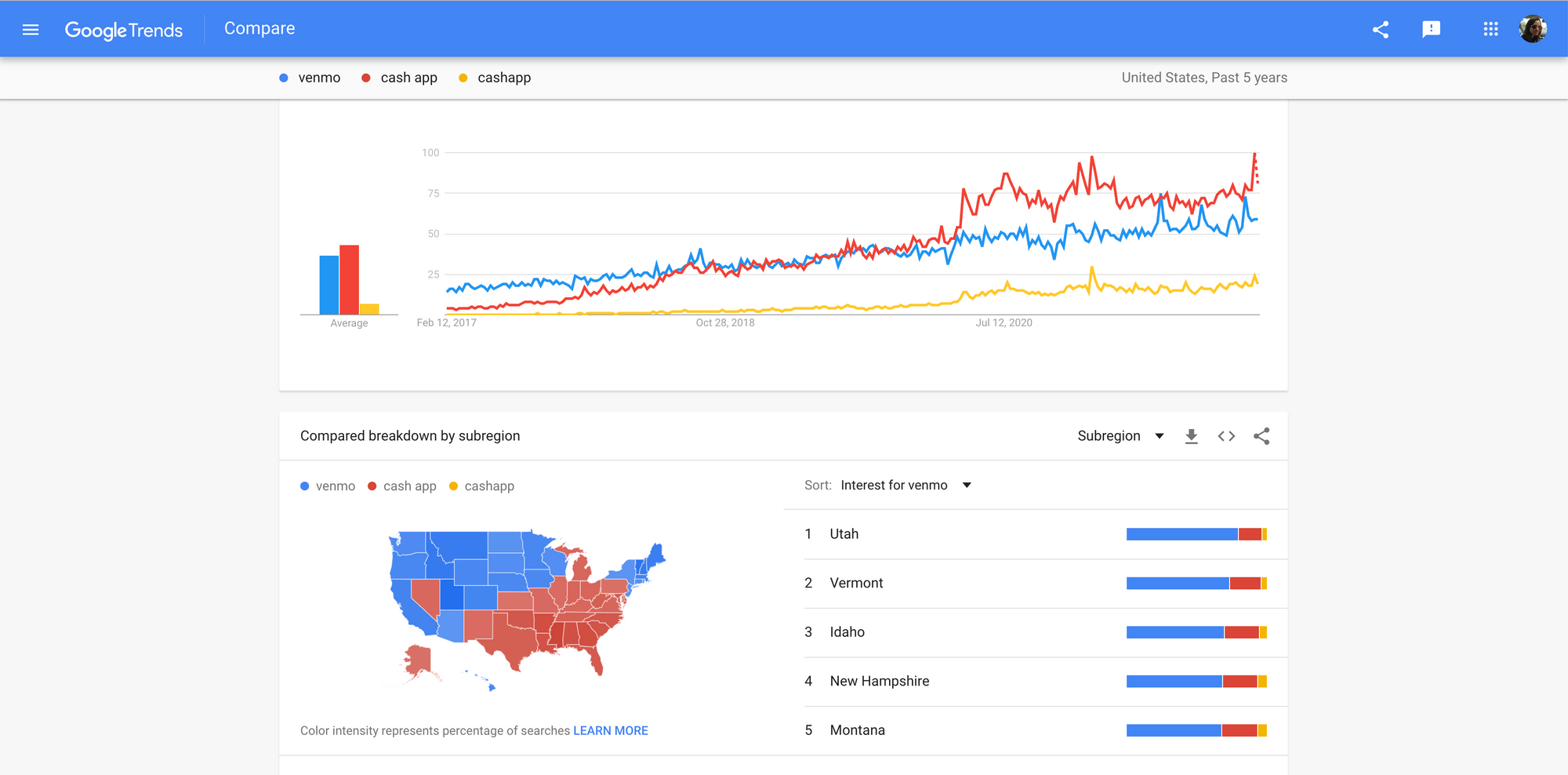

There’s one analyst I love in this space, Nolan Antonucci, who shares some of his research in this area. For instance, he’ll do a comparison of CashApp and Venmo, two payment platforms in the US, and see which ones he thinks is coming out ahead.

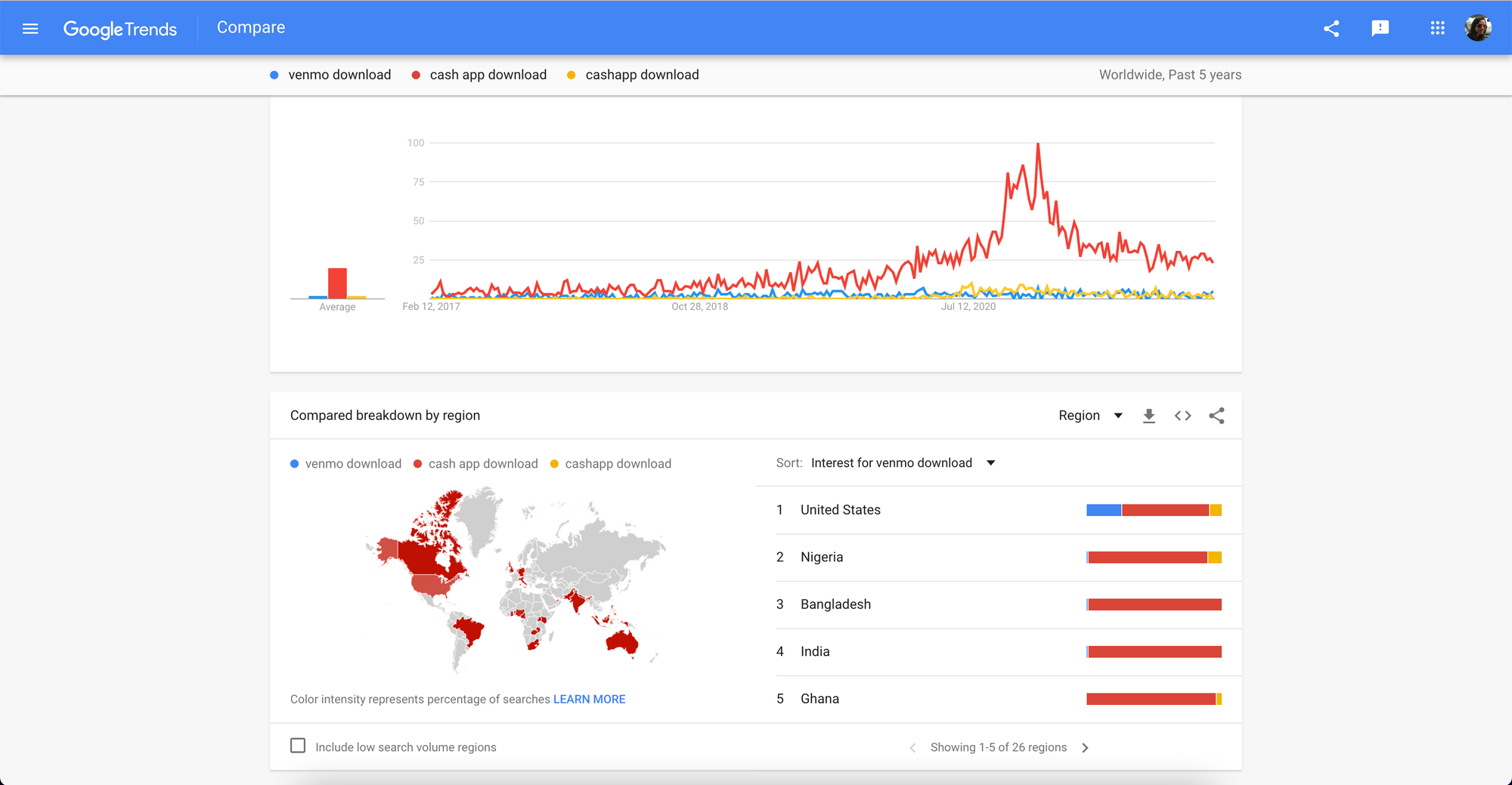

But he’s more analytical than just searching the product names, he’ll make sure he adds “download” to the search terms, for example, to see if it all lines up. He'll also change the regions around to see which is doing better at overseas expansion.

Or my fave example - an analyst was trying to gauge the sales of an electric car model before those actual numbers were released. I can’t remember which car it was; let's say it was the Taycan. Basically instead of searching for just "Taycan", and instead of just going one layer deeper and searching for "Taycan financing" which gives a better indication of buyers, they searched for the model of plug converter you’d need to buy if you owned a Taycan and wanted to charge it at Tesla charging stations. Given Tesla has an impressive charging network, that seems like a pretty decent way to gauge how many new Taycan owners there might be.

7. Patent Invalidation 👩⚖️

This one is crazy. There are patent lawyers out there who are trading. They find dodgy patents, particularly in the pharmaceutical industry, they short the company that holds it, and then they challenge the patent and get it withdrawn. The patent gets redacted, which means generic brands can start selling the same drug for way cheaper, the biotech company loses a bunch of value, and the original patent lawyer who shorted them rides off into the sunset.

8. Hacking Multi-tenant SaaS URLs to Discover Customer Acquisitions 💻

What now? This applies to some cloud-based software services, Atlassian’s Jira is an easy example of this, where you can take basically any company on earth, add the company name in front of .atlassian.net, and if the login page loads, that essentially tells you that that company is using Atlassian. Like fitnessfirst.atlassian.net. But Atlassian already has hundreds of thousands of customers, so what’s one more, who cares?

Let’s take Palantir instead, a data analytics company who have around 160 customers, so one more is a big deal. Let’s say Palantir’s announced that they’re trying to onboard more automotive companies as customers. Well, we can just type in something like gm.palantirfoundry.com, see the login page, try out any random email, and bam - looks like GM’s a customer, maybe that will put a big spike in Palantir’s earnings this quarter. Or maybe we find out that Pfizer is a customer of theirs (pfizer.palantirfoundry.com), and maybe that’s a sign they’re going to attack the broader health industry next.

8a. Job postings (again) 📣

We can also go back to the second strategy of monitoring job postings to find this information out, but indirectly, so instead of looking at Palantir’s job listings, we can look for Palantir in other companies' job listings, find companies that are hiring Palantir data science engineers, and that tells you what new customers Palantir has acquired. Like Henkel:

9. Following Politicians' Trades 🗑

Nine, following politicians trades. This one has been in the news a lot recently. Senators and representatives in the US are outperforming the market, most notably of late is Nancy Pelosi. They’ve made some very well-timed trades, for example buying options in big tech companies during periods of fear that big tech will be regulated, and then news comes out that they’re not getting regulated, and the stocks skyrocket again. Amazing how a politician would’ve had that foresight hey. These politicians do have to report their trades, but with a 45 day lag i think, but there could still opportunity there.

10. Inverting retail's trades 🤡

There are some people and groups on twitter, stocktwits, reddit, facebook - everywhere really - who only really make bad trades. They buy at peak hype and sell at peak fear. This strat is all about finding those people and using them as a contraindication. If they say they're going in on something, that might be a good short/exit signal. If they say a particular company is overvalued, maybe that's a good time to buy it.

11. Milking Hindenburg Speculators 📝

This is a little one I made up myself - it starts with following Hindenburg Research on twitter. Hindenburg is a successful short-selling firm that posts exposées into potentially fraudulent companies and they short those companies. Their most popular was a Nikola post.

The day before they post, they'll always give a heads up tweet to drum up hype. I’ve found it helpful as a trading signal to read all the replies about what companies everyone thinks Hindenburg will be targeting. Those companies make a great potential future shorting list. It’s the easiest way to steal other people’s knowledge on what companies out there are either scams or way overvalued, even if they aren’t the ones that Hindenburg were targeting.

The lesson to be learned here? Creativity can pay off in investing and trading.